For your convenience we selected regions (subjects of RF) where located cities with population over 500 thousand residents. Map of demand is based on the statistics of these regions. Map of demand on shoes and clothing displays expenditures per capita on purchased shoes and clothing in rubles, $, € and market volume in rub/$/€/ in 1 q. 2012.

Maps of demand by ‘Express-Obzor’ consist of 18 main slides (2 slides per each of 9 regional groups):

Map of demand on shoes and clothing in Russia

Consumer expenditures, $/€/RUB per capita

Market Volume, $/€/RUB.

Map of demand on shoes and clothing in Central FD (regions where located cities with population over 500 thousand residents)

Consumer expenditures, $/€/RUB per capita

Market Volume, $/€/RUB.

Map of demand on shoes and clothing in Northwest FD (regions where located cities with population over 500 thousand residents)

Consumer expenditures, $/€/RUB per capita

Market Volume, $/€/RUB.

Map of demand on shoes and clothing in Volga FD (regions where located cities with population over 500 thousand residents)

Consumer expenditures, $/€/RUB per capita

Market Volume, $/€/RUB.

Map of demand on shoes and clothing in Southern FD (regions where located cities with population over 500 thousand residents)

Consumer expenditures, $/€/RUB per capita

Market Volume, $/€/RUB.

Map of demand on shoes and clothing in North Caucasus FD (regions where located cities with population over 500 thousand residents)

Consumer expenditures, $/€/RUB per capita

Market Volume, $/€/RUB.

Map of demand on shoes and clothing in Urals FD (regions where located cities with population over 500 thousand residents)

Consumer expenditures, $/€/RUB per capita

Market Volume, $/€/RUB.

Map of demand on shoes and clothing in Siberian FD (regions where located cities with population over 500 thousand residents)

Consumer expenditures, $/€/RUB per capita

Market Volume, $/€/RUB.

Map of demand on shoes and clothing in Far East FD (regions where located cities with population over 500 thousand residents)

Consumer expenditures, $/€/RUB per capita

Market Volume, $/€/RUB.

About the company

Company Express-Obzor –since 2005 has been specializing in ready-made analytical market reports. Reports made my Express-Obzor’s specialists give an opportunity to receive basic information and a general idea of a market situation in a concise way. All assessments obtained in the course of a research are independent and impartial.

Over the past 7 years of activity the company:

has attended to more then 800 clients

MAP OF DEMAND ON SHOES AND CLOTHING RUSSIA, 1 q. 2012

1

Map of demand in Russia

2

Consumer expenditures, $/€/RUB per capita

3

Market Volume, $/€/RUB.

4

Map of demand in Central FD (regions where located cities with population over 500 thousand residents)

5

Consumer expenditures, $/€/RUB per capita

6

Market Volume, $/€/RUB.

7

Map of demand in Northwest FD (regions where located cities with population over 500 thousand residents)

8

Consumer expenditures, $/€/RUB per capita

9

Market Volume, $/€/RUB.

10

Map of demand in Volga FD (regions where located cities with population over 500 thousand residents)

11

Consumer expenditures, $/€/RUB per capita

12

Market Volume, $/€/RUB.

13

Map of demand in Southern FD (regions where located cities with population over 500 thousand residents)

14

Consumer expenditures, $/€/RUB per capita

15

Market Volume, $/€/RUB.

16

Map of demand in North Caucasus FD (regions where located cities with population over 500 thousand residents)

17

Consumer expenditures, $/€/RUB per capita

18

Market Volume, $/€/RUB.

19

Map of demand in Urals FD (regions where located cities with population over 500 thousand residents)

20

Consumer expenditures, $/€/RUB per capita

21

Market Volume, $/€/RUB.

22

Map of demand in Siberian FD (regions where located cities with population over 500 thousand residents)

23

Consumer expenditures, $/€/RUB per capita

24

Market Volume, $/€/RUB.

25

Map of demand in Far East FD (regions where located cities with population over 500 thousand residents)

26

Consumer expenditures, $/€/RUB per capita

27

Market Volume, $/€/RUB.

28

Рынок нижнего белья 2025

РБК Исследования рынков

49 000 ₽

Рынок нижнего белья 2025

РБК Исследования рынков

49 000 ₽

Исследование рынка мобильных приложений магазинов одежды в России: аналитика по результатам опроса пользователей (с обновлением)

Компания Гидмаркет

170 000 ₽

Исследование рынка мобильных приложений магазинов одежды в России: аналитика по результатам опроса пользователей (с обновлением)

Компания Гидмаркет

170 000 ₽

Продажи женской обуви на маркетплейсах 2024

РБК Исследования рынков

55 000 ₽

Продажи женской обуви на маркетплейсах 2024

РБК Исследования рынков

55 000 ₽

Продажи мужской обуви на маркетплейсках 2024

РБК Исследования рынков

55 000 ₽

Продажи мужской обуви на маркетплейсках 2024

РБК Исследования рынков

55 000 ₽

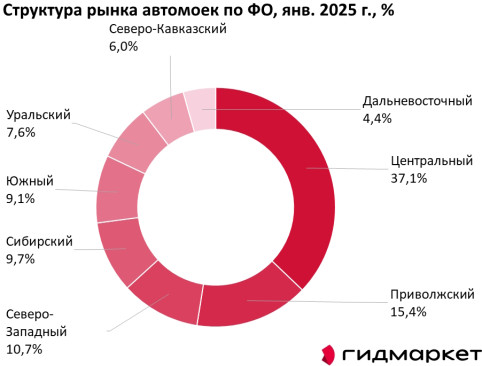

Статья, 9 декабря 2025

Компания Гидмаркет

Центральный округ собрал более трети всех российских автомоек

На Центральный федеральный округ, включая Москву, приходится 37,1% всех автомоек в стране, что делает его абсолютным лидером по концентрации этого бизнеса

Статья, 9 декабря 2025

Компания Гидмаркет

Центральный округ собрал более трети всех российских автомоек

На Центральный федеральный округ, включая Москву, приходится 37,1% всех автомоек в стране, что делает его абсолютным лидером по концентрации этого бизнеса

Российский рынок услуг по мойке автомобилей представляет собой динамичную и неравномерно распределенную по территории страны сферу предпринимательства. Его география напрямую отражает ключевые экономические и демографические реалии: плотность населения, уровень автомобилизации и покупательной способности граждан. Анализ структуры расположения автомоек по федеральным округам, основанный на данных на начало 2025 года, позволяет выявить четкие закономерности и центры притяжения для этого бизнеса.

Статья, 9 декабря 2025

Компания Гидмаркет

Как выбирают реабилитационный центр в 2024 году

Анализ потребительский предпочтений в контексте развития рынка медицинской реабилитации

Статья, 9 декабря 2025

Компания Гидмаркет

Как выбирают реабилитационный центр в 2024 году

Анализ потребительский предпочтений в контексте развития рынка медицинской реабилитации

Сфера медицинской реабилитации в России активно развивается. Всё больше людей понимают важность профессионального восстановления после болезней, операций или травм. Реабилитационный центр сегодня — это не просто место для ухода, а полноценное лечебное учреждение, где команда врачей, психологов и инструкторов помогает человеку вернуться к активной жизни.

Статья, 9 декабря 2025

Компания Гидмаркет

Центр России лидирует в производстве глины в 2024 году

Воронежская область стала лидером по производству глины в России в 2024 году, опередив Челябинскую область на 0,1%

Статья, 9 декабря 2025

Компания Гидмаркет

Центр России лидирует в производстве глины в 2024 году

Воронежская область стала лидером по производству глины в России в 2024 году, опередив Челябинскую область на 0,1%

Анализ географического распределения производства глины в России по итогам 2024 года выявил ярко выраженную концентрацию ключевых мощностей в европейской части страны.