Overview

This market research is aimed on the analysis of the Russian DIY market and its attractiveness for investors and suppliers of DIY goods.

The main topics of the report are:

Sources of information

The sources of information for the market research:

Description of the research:

This research is updated version of Inventica previous research of the Russian DIY market which was completed in summer 2011. New interviews with DIY chains representatives and suppliers were held and information about market players was verified.

The research consists of 4 main parts.

The first part of the research is focused on the macroeconomic factors which influence the development of the Russian retail and DIY market. Comparisons of all important indicators with developed and BRIC countries are also represented in the report.

The analysis helps to evaluate the influence of financial crisis on the DIY market and identify the factors determining the market to forecast its development in the mid-term perspective

In the second part of the research we concentrate on several questions, such as:

The third part of the research gives the detailed description of the operating conditions of Russian DIY chains including:

In the fourth part we provide financial solvency rating of DIY chain stores based on information obtained from DIY chain stores suppliers, commercial courts and other sources. This rating reflects the risks of default in payments to suppliers from certain retailers.

Additional information

The report is supplied with database of Russian DIY chain stores, which provides such information as:

The database contains additional information about TOP 10 DIY retailers:

|

CONTENTS |

2 |

||

|

Chapter 1. MACROECONOMIC REVIEW |

5 |

||

|

|

Gross domestic product (GDP) |

6 |

|

|

|

Comparison with foreign economies |

7 |

|

|

|

Inflation rates |

10 |

|

|

|

Nominal personal income and real disposable income |

11 |

|

|

|

Unemployment rate |

12 |

|

|

|

Retail turnover |

13 |

|

|

|

Global retail development index |

14 |

|

|

Chapter 2. DIY MARKET IN RUSSIA |

15 |

||

|

|

Sales of DIY and household goods in Russia |

16 |

|

|

|

Retail market segments |

17 |

|

|

|

Crisis impact on Russian DIY market |

19 |

|

|

|

Comparison of Russian DIY market with foreign countries |

20 |

|

|

|

Russian DIY market forecast |

22 |

|

|

Chapter 3. DIY RETAIL IN RUSSIA |

23 |

||

|

|

Specifics of the Russian DIY market |

24 |

|

|

|

Sales channels of DIY goods |

25 |

|

|

|

Types of Russian DIY stores |

27 |

|

|

|

Types of DIY chains in Russia |

28 |

|

|

|

DIY chain stores in Russian regions |

32 |

|

|

|

DIY hypermarkets in Russia |

33 |

|

|

|

DIY supermarkets in Russia |

36 |

|

|

Chapter 4. OPERATING CONDITIONS OF RUSSIAN DIY CHAIN STORES |

39 |

||

|

|

General requirements |

40 |

|

|

|

Entering DIY chains |

47 |

|

|

|

Delivery terms |

52 |

|

|

|

Payment terms |

63 |

|

|

|

Bonuses |

71 |

|

|

|

Marketing costs |

76 |

|

|

|

Penalties and total contract cost |

86 |

|

|

Chapter 5. FINANCIAL SOLVENCY RATING |

94 |

||

|

|

Rating overview |

95 |

|

|

|

Financial solvency rating |

96 |

|

|

|

Detailed overview of companies in the rating |

99 |

|

|

Appendix 1. DIY CHAIN STORES DATABASE |

113 |

||

|

Appendix 2. TOP 10 DIY CHAINS IN RUSSIA |

119 |

||

|

|

|

|

|

Рынок ритейла в России: DIY - 2023

AnalyticResearchGroup (ARG)

88 000 ₽

Рынок ритейла в России: DIY - 2023

AnalyticResearchGroup (ARG)

88 000 ₽

Анализ рынка саморезов в России - 2023. Показатели и прогнозы

TEBIZ GROUP

83 900 ₽

Анализ рынка саморезов в России - 2023. Показатели и прогнозы

TEBIZ GROUP

83 900 ₽

Анализ рынка строительных фенов (термофены) в России - 2022 год

DISCOVERY Research Group

60 000 ₽

Анализ рынка строительных фенов (термофены) в России - 2022 год

DISCOVERY Research Group

60 000 ₽

Анализ поведения и предпочтений покупателей товаров для ремонта

РБК Исследования рынков

5 000 ₽

Анализ поведения и предпочтений покупателей товаров для ремонта

РБК Исследования рынков

5 000 ₽

Статья, 26 июля 2024

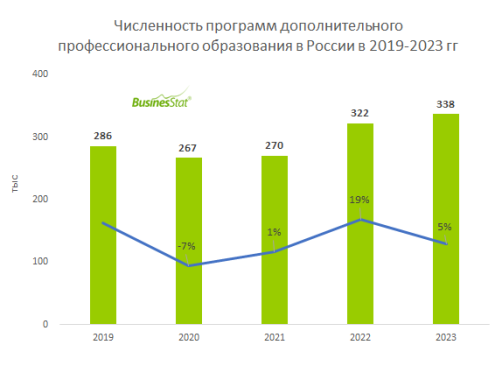

BusinesStat

За 2021-2023 гг количество программ дополнительного профессионального образования в России увеличилось на 27% и достигло 338 тыс.

Особенно востребованным становится ИТ-направление.

Статья, 26 июля 2024

BusinesStat

За 2021-2023 гг количество программ дополнительного профессионального образования в России увеличилось на 27% и достигло 338 тыс.

Особенно востребованным становится ИТ-направление.

По данным «Анализа рынка дополнительного профессионального образования в России», подготовленного BusinesStat в 2024 г, за 2021-2023 гг количество программ дополнительного профессионального образования в стране увеличилось на 27% и достигло 338 тыс. После временного спада в 2020 г образовательные организации вновь увеличили предложение учебных программ в ответ на потребности бизнеса и государства.

Статья, 26 июля 2024

BusinesStat

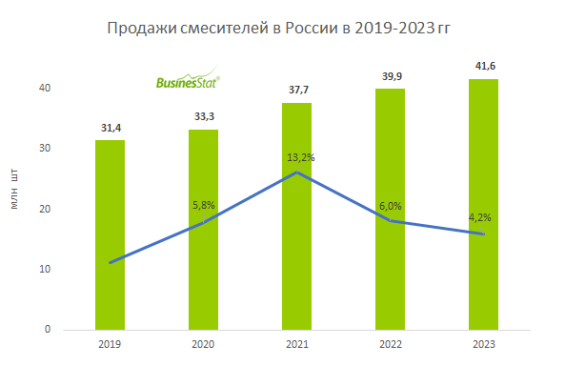

В 2023 г продажи смесителей в России увеличились на 4,2% и составили 41,6 млн шт.

Продажи смесителей поддержало увеличение поставок продукции эконом-сегмента из Китая.

Статья, 26 июля 2024

BusinesStat

В 2023 г продажи смесителей в России увеличились на 4,2% и составили 41,6 млн шт.

Продажи смесителей поддержало увеличение поставок продукции эконом-сегмента из Китая.

По данным «Анализа рынка смесителей в России», подготовленного BusinesStat в 2024 г, в 2023 г их продажи в стране увеличились на 4,2% и составили 41,6 млн шт. В течение последних лет продажи ежегодно росли, главным драйвером продаж были рекордные объемы ввода в эксплуатацию новых зданий и выданных льготных ипотечных кредитов, которые стимулировали спрос в отраслях, смежных со строительством.

Статья, 26 июля 2024

BusinesStat

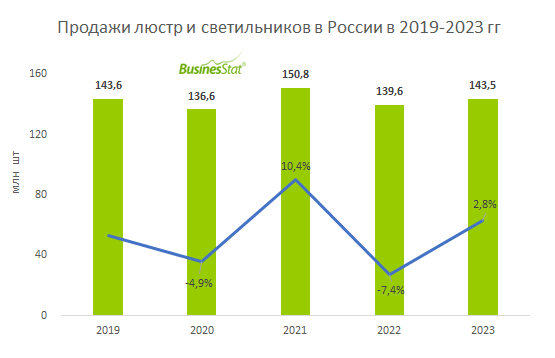

В 2023 г продажи люстр и светильников в России выросли на 3% и составили 144 млн шт.

После ухода иностранных брендов отечественные компании смогли занять освободившиеся ниши.

Статья, 26 июля 2024

BusinesStat

В 2023 г продажи люстр и светильников в России выросли на 3% и составили 144 млн шт.

После ухода иностранных брендов отечественные компании смогли занять освободившиеся ниши.

По данным "Анализа рынка люстр и светильников в России", подготовленного BusinesStat в 2024 г, в 2023 г их продажи в стране выросли на 3% и составили 144 млн шт.